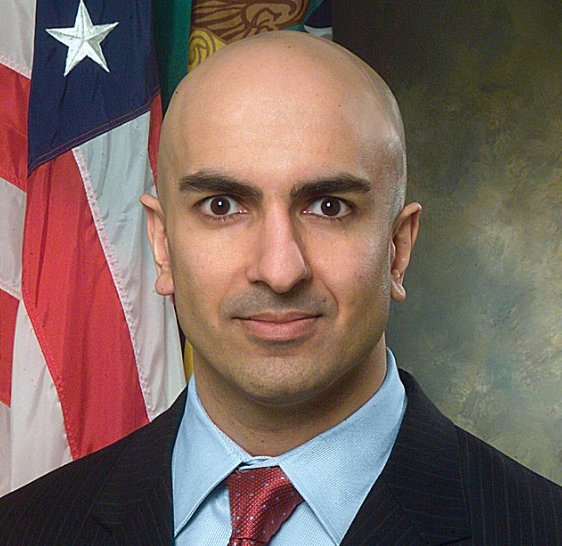

The Federal Reserve, the central bank of the United States, has been a topic of discussion in recent years due to its role in shaping the country's economic landscape. Neel Kashkari, the President of the Federal Reserve Bank of Minneapolis, has been vocal about his views on the Fed's intervention in the economy. According to Kashkari, the Fed should intervene only reluctantly and still needs to squash inflation. In this article, we will delve into Kashkari's views and explore the implications of the Fed's intervention in the economy.

Kashkari's Stance on Fed Intervention

Kashkari has emphasized the importance of the Fed intervening in the economy only when necessary. He believes that the Fed should not overstep its boundaries and interfere with the natural functioning of the market. However, he also acknowledges that there are situations where the Fed's intervention is necessary to prevent economic instability. Kashkari's stance is rooted in the idea that the Fed's actions can have unintended consequences, such as creating asset bubbles or distorting market prices.

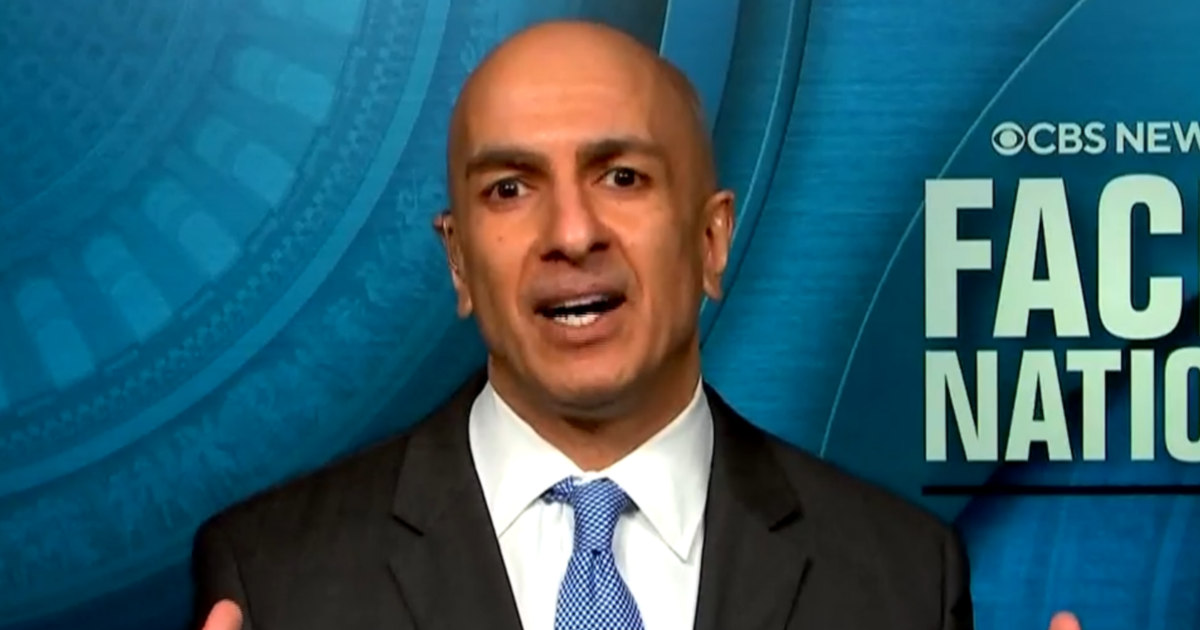

The Need to Squash Inflation

One of the primary concerns for the Fed is inflation. Kashkari has stated that the Fed still needs to squash inflation, which has been a persistent issue in recent years. The Fed's dual mandate is to promote maximum employment and price stability, and inflation is a key indicator of price stability. If inflation is too high, it can erode the purchasing power of consumers and reduce the value of savings. The Fed uses monetary policy tools, such as interest rates and quantitative easing, to control inflation and maintain price stability.

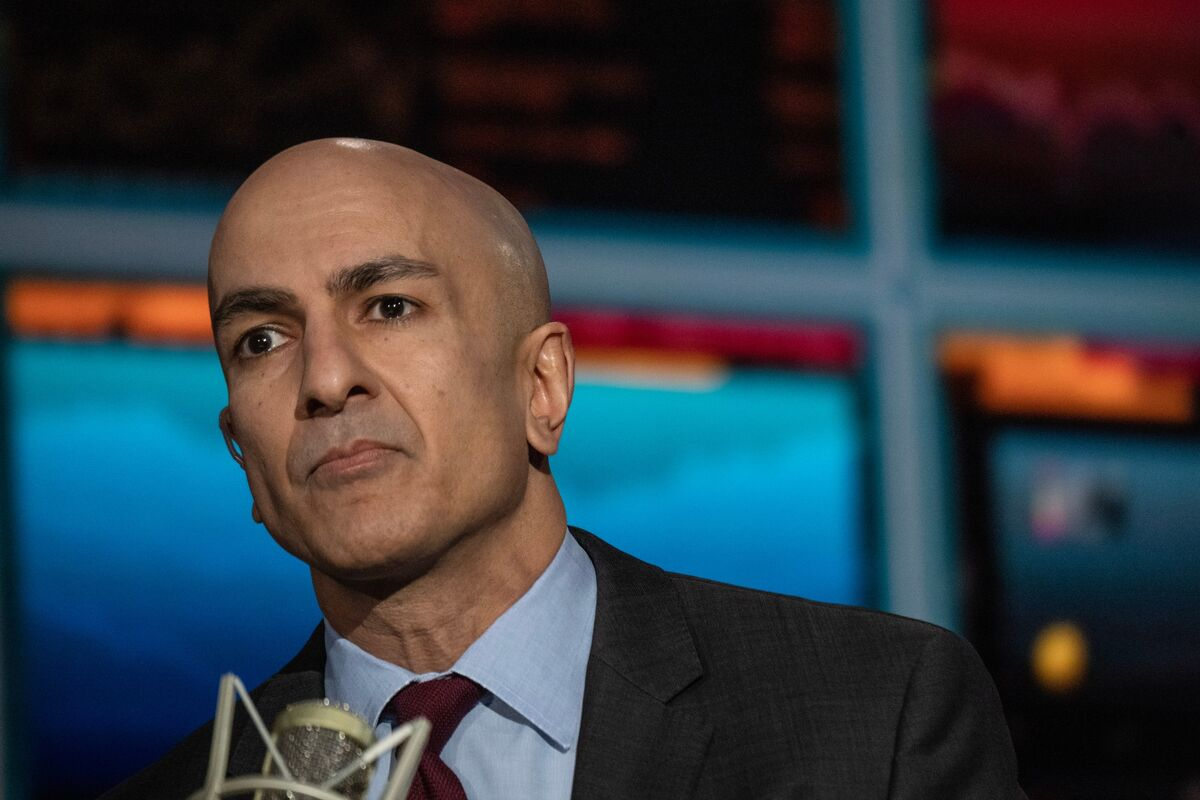

Implications of Fed Intervention

The Fed's intervention in the economy can have far-reaching implications. On the one hand, the Fed's actions can help stabilize the economy during times of crisis and prevent a complete collapse of the financial system. On the other hand, the Fed's intervention can also create moral hazard, where investors and financial institutions take on excessive risk, knowing that the Fed will bail them out if things go wrong. Additionally, the Fed's actions can also lead to asset bubbles, where prices become detached from their fundamental values.

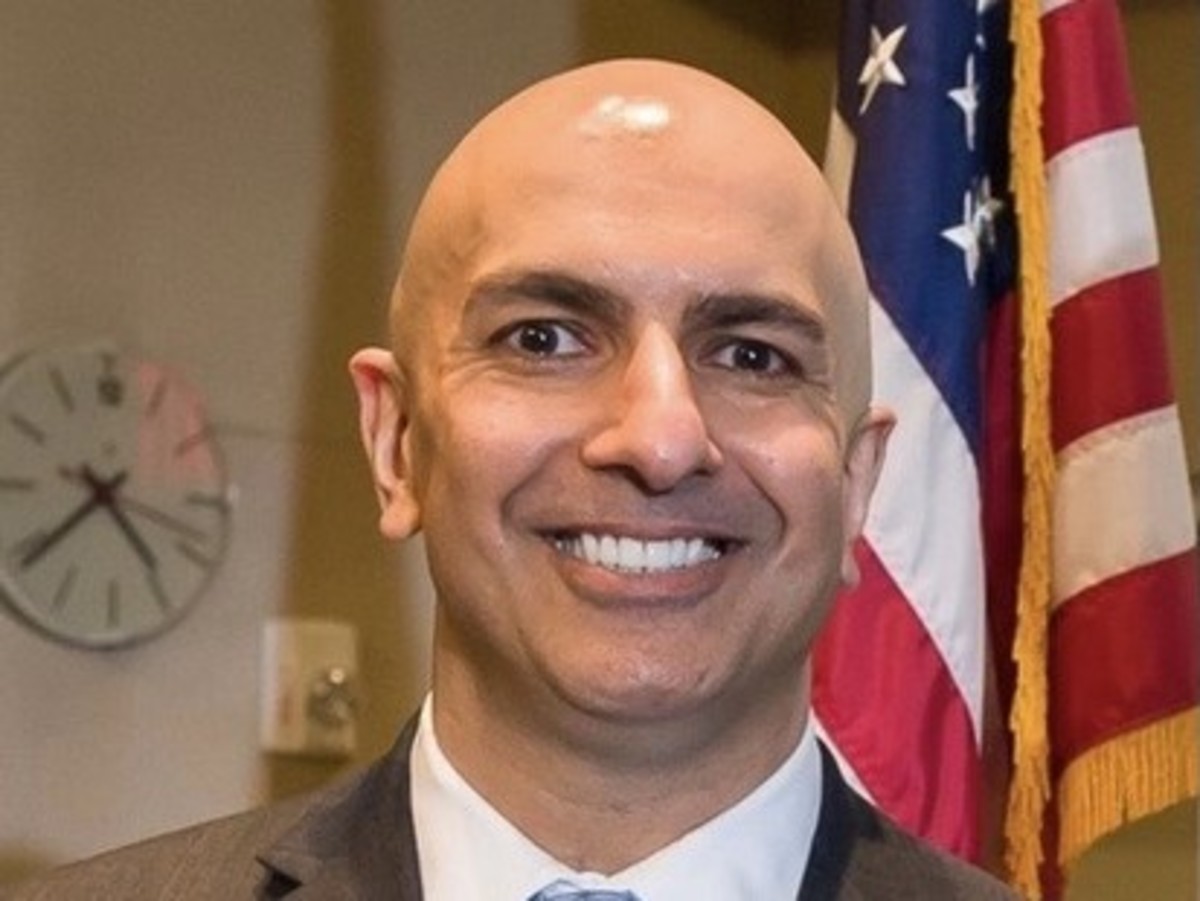

In conclusion, Kashkari's views on Fed intervention highlight the delicate balance that the central bank must strike. While the Fed's intervention is necessary to prevent economic instability, it must also be done reluctantly and with caution. The Fed's primary goal is to promote maximum employment and price stability, and it must use its monetary policy tools judiciously to achieve these goals. As the economy continues to evolve, it will be important to monitor the Fed's actions and ensure that they are aligned with its dual mandate.

By understanding the implications of Fed intervention, investors and policymakers can make informed decisions that promote economic stability and growth. The Fed's role in shaping the economy is crucial, and its actions will continue to be closely watched in the years to come.

Some of the key takeaways from Kashkari's views on Fed intervention include:

- The Fed should intervene only reluctantly and with caution.

- The Fed still needs to squash inflation to maintain price stability.

- The Fed's actions can have unintended consequences, such as creating asset bubbles or distorting market prices.

- The Fed's primary goal is to promote maximum employment and price stability.

As the economy continues to navigate the complexities of the post-pandemic world, the Fed's role will be crucial in shaping the economic landscape. By understanding the implications of Fed intervention, we can better navigate the challenges and opportunities that lie ahead.