Table of Contents

- MU Stock Price and Chart — NASDAQ:MU — TradingView

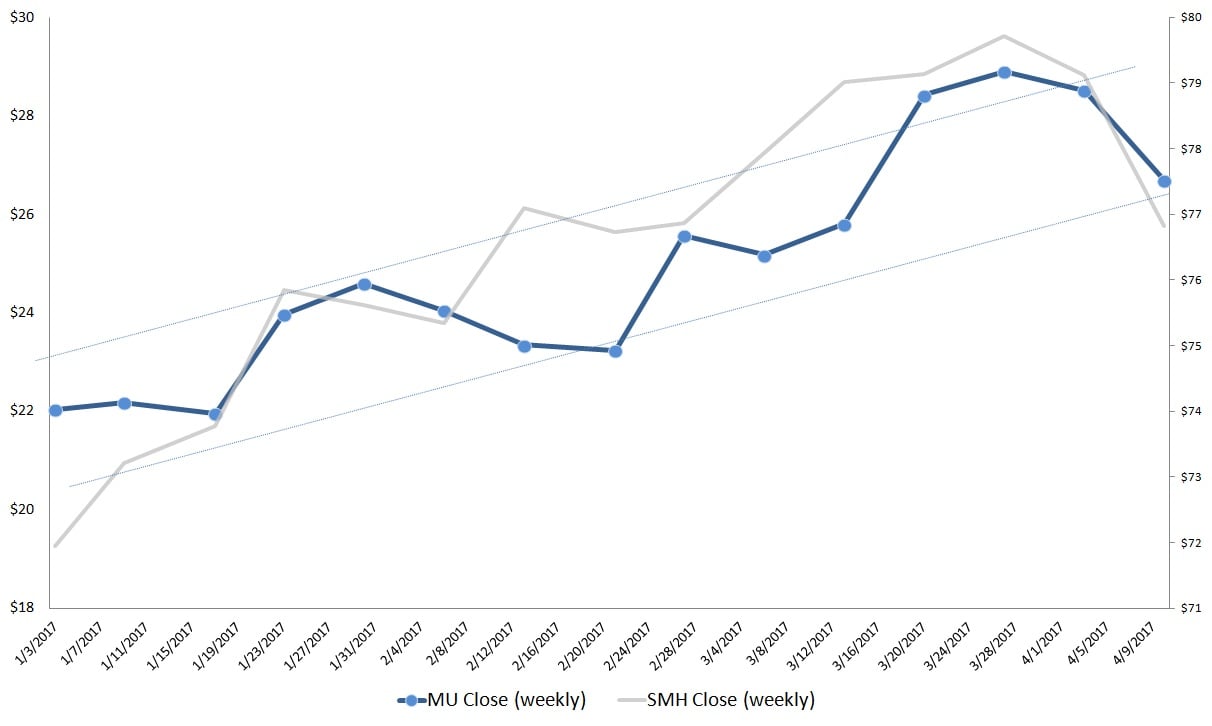

- Micron Technology, Inc. (MU) Stock Still Has Plenty of Time to Grow ...

- 3 Reasons to Own $MU - Research

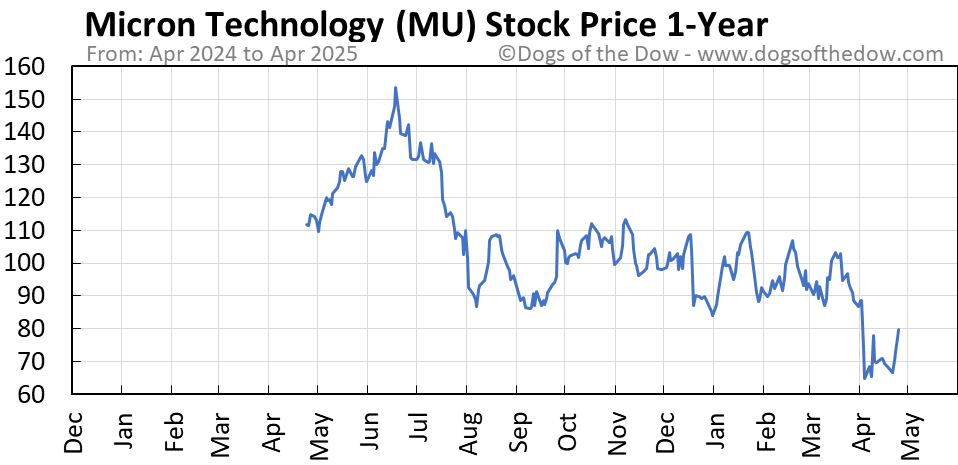

- MU Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- MU Stock Price and Chart — NASDAQ:MU — TradingView

- MU Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- Micron Technology | $MU Stock | Shares Slump On Memory Chip Ban ...

- Micron Technology (MU) Stock Is Up in After-Hours Trading on Earnings ...

- MU Stock Price and Chart — NASDAQ:MU — TradingView

- MU Stock Price and Chart — NASDAQ:MU — TradingView — India

Current Stock Price

Factors Influencing Stock Price

Analyst Predictions

Analysts have varying opinions on the future performance of Micron Technology Inc. (MU). Some analysts predict that the company's stock price will rise in the coming months, driven by increasing demand for semiconductor devices and the company's strong financial position. Others, however, are more cautious, citing the intense competition in the industry and the potential for decreased demand due to economic uncertainty. In conclusion, the stock price of Micron Technology Inc. (MU) is influenced by a variety of factors, including global demand, competition, technological advancements, and economic conditions. As the technology sector continues to evolve, it is essential to stay informed about the latest developments and trends that may impact Micron's stock price. Whether you are a seasoned investor or just starting to explore the world of stocks, keeping a close eye on the company's performance and the overall market trends can help you make informed investment decisions.For the latest updates on Micron Technology Inc. (MU) stock price, visit the Wall Street Journal website.

Note: The current price, low price, and high price should be replaced with the actual values. Also, the article should be optimized with relevant keywords, meta description, and header tags for better SEO ranking.